If you d like a refund simply submit this completed form to our solar billing specialists and we ll refund you via deposit into your account or post out a cheque to you.

Origin energy solar panel rebate.

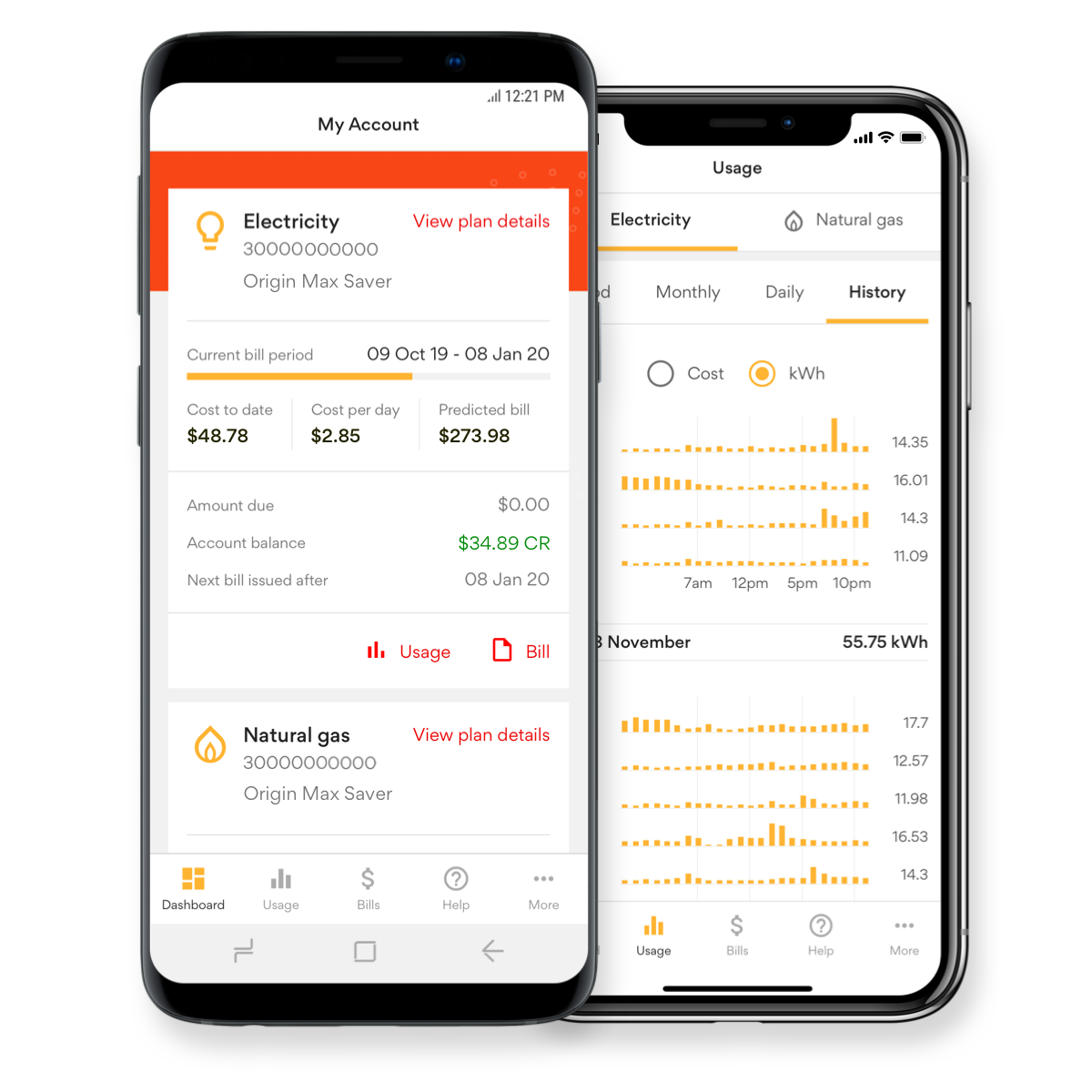

At origin we let you choose how you d like to receive your solar credits.

When you don t use all the solar energy you ve generated the excess electricity feeds back to the grid and you could get paid for it in cents per kwh.

Energy accounts payment assistance scheme.

Origin energy works with local businesses in calgary to determine how solar installs can help with peak shaving.

If you decide to go solar net metering is an important policy to understand.

South carolina solar power.

Like many other states south carolina has a net metering policy that lets homeowners with solar energy systems bank the extra electricity their solar panels produce when you need more power than you re generating.

Please don t hesitate in contacting the energy matters team for expert advice on rebates that may be applicable to you.

The rebate is for independent self funded retirees only.

Pensioners and veterans may be eligible for the 285 low income household rebate.

We are providing a rebate of up to 1 850 for solar panel pv system installation for homeowners and rental properties.

We can either add it to your electricity bill or refund the amount to your nominated bank account.

To find what s available fill in the search with some information about yourself and where you are in australia.

A feed in tariff fit is a payment you could receive for any excess solar electricity your solar energy system generates that can be sent back to the grid.

The key benefits and incentives net metering in south carolina.

A brief summary on the various solar rebates programs is below.

Apply for the seniors energy rebate.

You can add more information about the topic you re interested in like solar pv or energy efficiency and what type of support like grants rebates or apps.

South carolina got started with solar policy in 2006 with a solar energy tax credit nearly three decades later than the first solar policies enacted elsewhere in the country.

Many businesses have to pay large premiums due to heavy seasonal or spikey electrical demands.

The policy grants a 25 percent tax credit for the purchase and installation of a solar system.

However the tax credit was a great place to start.

This rebate provides eligible households with a 200 rebate per year to help with the cost of living.

To further reduce installation costs householders can apply for an interest free loan for an amount equivalent to their rebate amount.

You could also see if there s additional support available during covid 19 from the australian government or the state.